BTU Announces Agreements with Kinross Gold Corporation: Private Placement, Asset Purchase Agreement and Option Agreement

February 22, 2023, Vancouver, BC, Canada – BTU METALS CORP. (“BTU” or the “Company”) (BTU-TSX:V BTUMF-OTC) has entered into a series of transactions (collectively, the “Transactions”) with Kinross Gold Corporation (“Kinross") that will strengthen the exploration effort on the significant properties of BTU in the Great Bear gold area southeast of the main Red Lake Gold camp area of northwestern Ontario (the “Dixie Halo Project”). The Dixie Halo Project is located adjacent to Kinross’s Great Bear project (the “Great Bear Project”) that Kinross, on February 13, 2023, headlined in a press release: “Kinross announces robust initial mineral resource of 2.7 Moz. indicated and 2.3 Moz. inferred for Great Bear project”.

The Transactions include: (i) a purchase agreement pursuant to which Great Bear Resources Ltd., a wholly-owned subsidiary of Kinross, (“GBR”) acquired from BTU certain unpatented mining claims located in the Kenora District of Ontario, with BTU continuing to participate in those lands through a newly created royalty payable to BTU; (ii) an option agreement, which provides GBR with an option to earn a 70% interest in certain unpatented mining claims held by BTU located in the Kenora District of Ontario; and (iii) a subscription agreement pursuant to which Kinross purchased 25,000,000 common shares of BTU at a purchase price of CAD$0.05 per common share.

BTU CEO Paul Wood commented; “We are very pleased to enter into this series of transactions with Kinross, which will: provide CAD$2.8 million in cash to the Company by way of a private placement and property sale, accelerate the exploration of BTU’s properties through an earn-in agreement of up to CAD$4.7 million, and, in all cases, leave substantial upside for BTU shareholders through a royalty package and its at least 30% interests in the Optioned Properties of the Dixie Halo Project. BTU will fully support Kinross as they commence their exploration work on the Optioned Properties and we are very pleased to have Kinross as a partner. The Company is also in the process of sourcing, accepting and assessing new and complementary minerals exploration projects to add to and diversify our property portfolio.”

Kinross commented; “We are pleased to be working with the BTU Metals team to advance the Dixie Halo property, which is adjacent to Kinross’ 100% owned Great Bear project.”

Subscription

The Company has entered into a subscription agreement with Kinross for gross proceeds of approximately CAD$1,250,000 million in an arms-length private placement (the “Private Placement”) of its common shares (the “Common Shares”), comprised of 25,000,000 Common Shares at a purchase price of CAD$0.05 per Common Share. The net proceeds of the private placement will be used by the Company for investments, general and working capital purposes.

The Private Placement closed on February 22nd, 2023, subject to the satisfaction of customary closing conditions, including the final approval of the TSX Venture Exchange (the “TSX-V”). Kinross became an insider of the Company upon the closing of the Private Placement, and holds 25,000,000 Common Shares, representing 17.5% of the issued and outstanding Common Shares.

The Common Shares will have a hold period of four months and one day from the closing date of the Private Placement.

Asset Acquisition

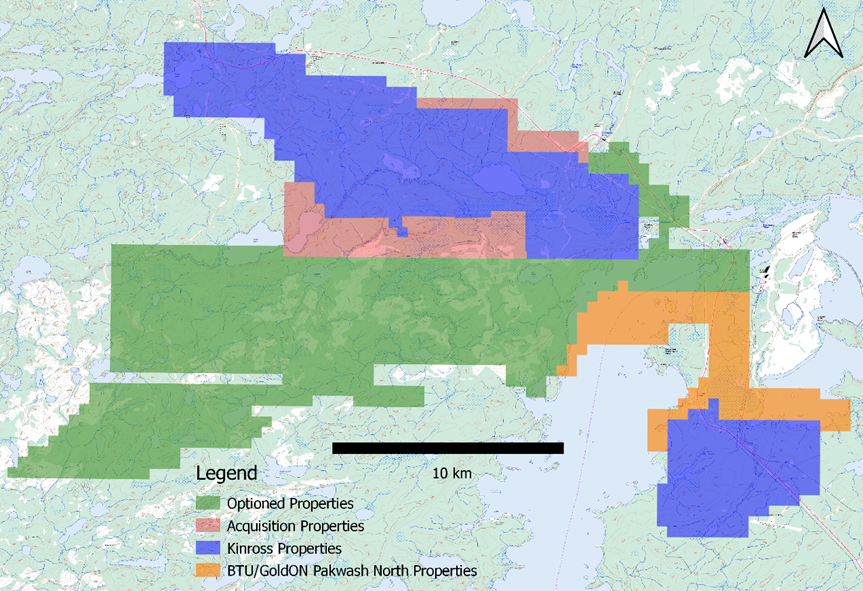

The Company has also entered into a purchase agreement with GBR, a wholly-owned subsidiary of Kinross, for the purchase (the “Acquisition”) of certain unpatented mining claims located in the Kenora District of Ontario (the “Acquisition Properties”). The Acquisition Properties have a total area of 2,637 hectares, and consist of 39 Boundary Cell Mining Claims and 76 Single Cell Mining Claims located to the south of the Great Bear Project, as well as 2 Multi-cell Mining Claims located to the north of the Great Bear Project (see Figure 1). BTU will hold Net Smelter Royalties from 1.5% to 2.5% on these properties as well as underlying royalty buy back rights.

The consideration payable by GBR pursuant to the Acquisition is: (i) CAD$1,550,000 in cash, with CAD$1,250,000 due immediately on closing and an additional CAD$300,000 due on the one-year anniversary of the closing date, and (ii) GBR issued to the Company a variable 1.5% - 2.5% NSR royalty on the Acquisition Properties (the “Royalty”), such that each Acquisition Property will have a cumulative total 4% NSR royalty attached to it upon the grant of the Royalty, once combined with the existing royalties payable over and in respect of the Acquisition Property. BTU will maintain any existing third-party royalty buy-back rights in respect of the Acquisition Properties.

Figure 1: Map showing the Acquisition Properties, Optioned Properties ase well as Kinross's properties and the BTU/GoldON Pakwash properties. The Great Bear Project mineral resource is located on the northern Kinross property on this map.

The Acquisition is an arm's length transaction pursuant to the policies of the TSX-V and closed on February 22nd, 2023, subject to satisfaction of customary closing conditions, including the final approval of the TSX-V.

Option Agreement

The Company is also pleased to announce that it has entered into a property option agreement (the “Option Agreement”) with GBR, pursuant to which GBR has been granted the right to acquire an undivided 70% interest in and to 757 mining claims (12 Boundary Cell Mining Claims, 3 Multi-cell Mining Claims, and 742 Single Cell Mining Claims) covering approximately 16,410 hectares of land, located in the Kenora District of Ontario (the “Optioned Properties”).

Pursuant to the terms of the Option Agreement, GBR has the option to acquire the 70% interest in the Optioned Properties in consideration for completing cash payments or exploration expenditures on the Optioned Properties, being: (i) CAD$2,700,000 in expenditures, to be incurred by GBR on or before the date that is 36 months from the effective date of the Option Agreement, and (ii) a further CAD$2,000,000 of expenditures, to be incurred by GBR in its sole discretion within 48 months from the effective date of the Option Agreement.

The Option Agreement will constitute a reviewable transaction under TSX-V Policy 5.3 – Acquisitions and Dispositions of Non-Cash Assets as it will, if completed, result in a disposition of more than 50% of the Company’s assets. As such, the Option Agreement will be subject to the approval of the majority of the shareholders of the Company and the Company intends to call a meeting of shareholders as soon as practicable for the purposes of approving the Option Agreement. The closing of the Private Placement and the Acquisition are independent of, and not conditional upon, the closing of the Option Agreement. Further details will be provided in a subsequent press release.

The Option Agreement will also be subject to satisfaction of customary closing conditions, including the final approval of the TSX-V.

During the term of the Option Agreement, GBR will be the operator of the Optioned Properties.

No new control person will be created as a result of the Transactions and no finders’ fee is payable by any party with respect to the Transactions.

Early Warning Disclosure

In connection with the Private Placement, Kinross acquired 25,000,000 Common Shares. Kinross now holds an aggregate of 25,000,000 Common Shares representing approximately 17.5% of the then issued and outstanding Common Shares on a non-diluted basis, requiring disclosure pursuant to the early warning requirements under applicable securities laws. Kinross does not have any current intentions to significantly increase or decrease its beneficial ownership of, or control or direction over, any additional securities of the Company. Kinross may, from time to time, and depending on market and other conditions, acquire Common Shares through market transactions, private placements, treasury issuances, convertible securities, or otherwise sell all or some portion of the Common Shares owned or controlled, or may continue to hold the Common Shares.

Kinross’s head office is location at 25 York Street, 17th Floor, Toronto, Ontario M5J 2V5.

The forgoing disclosure is being disseminated pursuant to the requirements of National Instrument 62-103 – The Early Warning System and related Take-Over Bid and Insider Reporting Issues of the Canadian Securities Administrators, which also requires an early warning report to be filed with the applicable securities regulators containing additional information with respect to the forgoing matters. A copy of the early warning report in respect of the Private Placement will be available on the Company’s profiled on SEDAR at www.sedar.com.

About BTU

BTU Metals Corp. is a junior mining exploration company focused on the Dixie Halo Project located in Red Lake, Ontario immediately adjacent to the Great Bear Project.

ON BEHALF OF THE BOARD

“Paul Wood”

Paul Wood, CEO, Director

pwood@btumetals.com

BTU Metals Corp.

Telephone: 1-604-683-3995

Toll Free: 1-888-945-4770

Cautionary Statement

Trading in the securities of the Company should be considered highly speculative. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains certain “forward-looking information” within the meaning of applicable Canadian securities laws that are based on expectations, estimates and projections as at the date of this news release. The information in this release about future plans and objectives of the Company, including the intention to complete the Private Placement and the expected expenditure of the proceeds of the Private Placement, the intention to complete the Acquisition and the intention to Complete the transactions contemplated under the Option Agreement are forward-looking information. Other forward-looking information includes but is not limited to information concerning: the intentions, plans and future actions of the Company.

Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information.

This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others: the Company’s ability to obtain all approvals required in connection with the Private Placement, Acquisition and Option Agreement and successfully complete the Private Placement, Acquisition and Option Agreement; risks relating to the global economic climate; dilution; future capital needs and uncertainty of additional financing; the competitive nature of the industry; currency exchange risks; the need for the Company to manage its planned growth and expansion; the effects of product development; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; reliance on key personnel; global economic and financial market deterioration impeding access to capital or increasing the cost of capital; and volatile securities markets impacting security pricing unrelated to operating performance. The Company has also assumed that no significant events occur outside of the normal course of business. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to revise or update any forward-looking information other than as required by law.